Share this

Circularity: The New Buzzword in Tech (and Maybe the Market) - AMD & OpenAI

by Dane Czaplicki on Oct 06, 2025

This morning, AMD and OpenAI announced a partnership that—on paper—looks like a potential win-win. AMD supplies the chips, OpenAI buys the chips, trains on the chips, and uses the results to… design better chips….to buy more chips…all while the more AMD chips OpenAI buys, the more of AMD OpenAI starts to own in AMD stock (through warrants)…getting dizzy. To be expected. That’s ok. Or is it not? Do I even have this straight? How could I?

That’s circularity.

I have seen reference to circularity more and more, and it has become a new favorite in the tech and sustainability world—used to describe self-reinforcing systems where outputs feedback as inputs. Circular economies reuse resources. Circular software improves itself. Circular financing recycles capitalii . A lot of sounds good until I get to circular financing and think back to my youth and being fascinated by the concept of a perpetual motion machine…and, according to ChatGPT this morning, yes Dane perpetual motion is still impossible, at least according to the laws of physics as we understand them today.

So as I understand it and IMO, in markets, circularity can start to sound a lot like reflexivity iii —George Soros’ word for feedback loops between perception and price, introduced in his 1987 book The Alchemy of Finance (THIS BOOK BY THE WAY IS NOT AND I STRESS NOT AN EASY READ). When optimism funds expansion, expansion validates optimism, and optimism funds more expansion… you get what looks suspiciously like a bubble.

The Circle Tightens

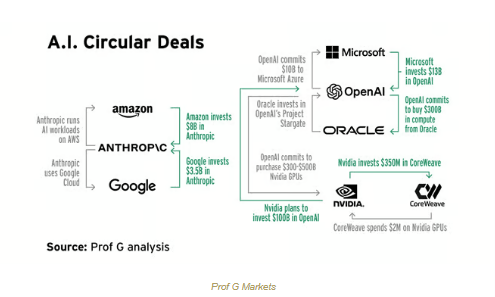

Look at the “A.I. Circular Deal” graph I saw last week.

Each arrow connected a company investing in its own future through its customers, suppliers, or competitors. Nvidia funds AI startups → AI startups buy Nvidia chips → Nvidia’s profits fund more AI startups.

Now add AMD and OpenAI to the loop. The circle just got bigger and tighter.

The problem with circles is they have no exits. Everyone inside depends on everyone else to keep believing. When that belief wavers or when funding slows or demand plateaus, the system may not bend. It would then likely break.

Search Interest, Search for Meaning

A quick Google Trends and ChatGPT search comparison for “bubble” shows the word itself spiking every time prices do. We talk about bubbles most when we’re already in them.

Which raises the question: Can we be in a bubble if everyone already thinks we’re in a bubble?

Maybe not immediately. Awareness doesn’t deflate optimism, it intellectualizes it. Investors say, “Yes, it’s frothy, but this time it’s different.” Until it isn’t.

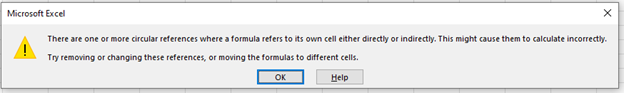

Circular References

In Excel, a circular reference happens when a formula refers back to itself. The program flashes a warning: “Circular reference detected.”

The sheet may keep running, but the math stops making sense. Or it breaks.

Maybe that’s where we are in markets today—still running, still computing, but with logic starting to fold back on itself. With warning in excel, you can fix the reference and be on your way. Will we in the market?

Final Thought

Circularity can be brilliant design, or a dangerous delusion. The difference is whether the loop creates value or just velocity.

As investors, our job isn’t to break the loop. It’s to know when it’s producing real output or when it’s just spinning (out of control?).

Being a long term user of Excel, I know it knows how to flag a circular reference… does ChatGPT, OpenAI and all of the investors know how to flag a circular reference?

Curious how circularity might be showing up in your own portfolio?

Schedule a conversations with us today.

iiHere’s a bit more context from ChatGPT:

- In tech and sustainability, circularity is indeed a buzzword describing self-reinforcing or regenerative systems — where outputs become inputs rather than being discarded.

- Circular economy: a widely recognized concept promoted by the Ellen MacArthur Foundation, referring to reusing, recycling, and regenerating materials to minimize waste and resource extraction.

- Circular software or AI systems: used metaphorically to describe feedback-driven models that “learn” or “improve themselves” through continuous iteration.

- Circular financing: a newer application, often referring to financial flows that reinvest gains back into the same ecosystem — e.g., venture investors funding infrastructure that increases the value of their own holdings (as seen in AI and cloud partnerships).

iiiThe Alchemy of Finance (1987) – This is the cornerstone text. Soros outlines how markets are not purely driven by fundamentals but by feedback loops between perception and reality — what he calls “reflexivity.” He applies it to currency markets, equity booms and busts, and his own trading diary from the 1980s. THIS BOOK BY THE WAY IS INTENSE. NOT AN EASY READY.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author

Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- February 2026 (5)

- January 2026 (6)

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)