Share this

Federal Reserve Makes First Rate Cut of 2025 — What It Means

by Tim Macarak on Sep 18, 2025

- Two-Sided Risk (aka No Free Lunch): Powell’s big line today:

“So we have a situation where we have two-sided risk, and that means there’s no risk-free path.” - Translation: the Fed is worried about two things at once, stubborn inflation and a weakening job market. It is concerning when the guy running the monetary system basically admits he’s choosing between the fire and the frying pan.

- Risk Management Cut: Powell labeled this a “risk-management” move, Fed-speak for “we’re not really sure which way things are breaking, but we’re going to ease a little just in case.” That’s not exactly a confidence booster, but at least he said it with a straight face.

- The SEP and Dot Plot: For those new to Fed bingo, SEP = Summary of Economic Projections. Every quarter, Fed governors and presidents submit forecasts for growth, unemployment, inflation, and most fun of all, where they think interest rates are going. These get turned into the famous “dot plot.”

-

- The median forecast shows two more cuts this year, but views were notably divergent.

- Inflation expectations? Roughly the same as June (around 3%).

- GDP growth? About the same too, a hair higher (1.6%).

- Translation: the economy hasn’t changed much, but the Fed is feeling twitchier.

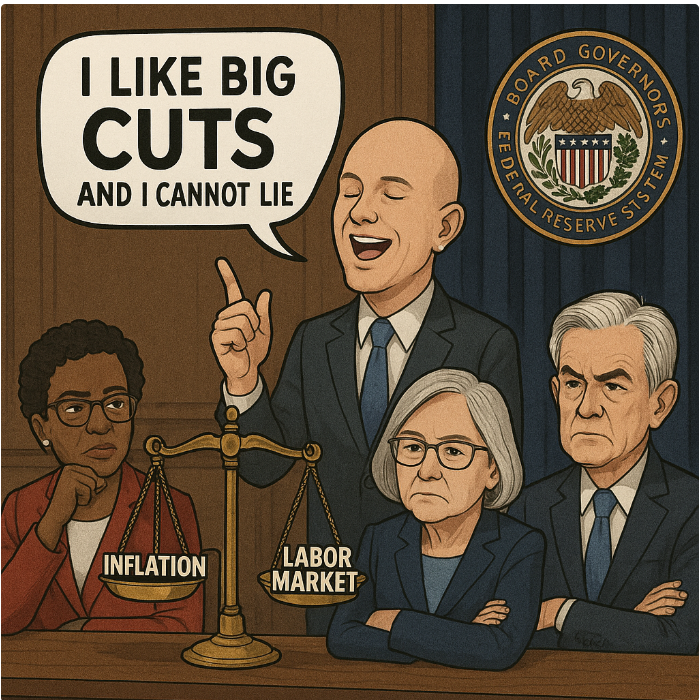

- The Outlier: Stephen Miran

Newly sworn-in Governor Stephen Miran immediately made his presence known by dissenting and calling for a 50-basis-point cut. Nothing like showing up to your first day of work and telling everyone they’re being too timid.

- Equities: Markets barely blinked at the 25bps cut — they saw this coming. The real juice was Powell’s hints at more cuts to come.

- Treasuries: The 10-year yield bounced a few basis points as investors squinted at the SEP and thought, “Is this actually dovish or just Powell hedging again?”

- Dollar: The greenback flexed a little, not a massive move, but enough to remind people it’s still the world’s reserve currency.

- Gold: Our shiny old friend kept running, feeding on lower real yields, global uncertainty, and perhaps a general sense that nobody trusts paper anymore.

- Lisa Cook: Trump tried to fire her, but a court ruling said “nope.” So she walked into the FOMC meeting the next morning, very much still employed.

- Stephen Miran: Approved by the Senate literally yesterday. Less than 24 hours later, he’s already throwing elbows with a call for a double-sized cut. Subtlety isn’t his thing, but he’s definitely making headlines.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author – Tim Macarak CFP®

Tim Macarak is President & Head of Wealth Management at Member’s Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure overtime, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Tim and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs and is determined to put service before all else.

Tim is a CERTIFIED FINANCIAL PLANNER® Professional. Outside work, he enjoys spending time with his wife and kids, Skiing, Coaching, and Traveling. To learn more about Tim, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- February 2026 (1)

- January 2026 (6)

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)