Share this

Jackson Hole Drama: Powell Whispers, Investors Shout

by Tim Macarak on Aug 25, 2025

Intro

Welcome to your post-weekend reading fix—where we parse Friday's Jackson Hole speech from Fed Chair Jerome Powell, sprinkle in a little sarcasm (because why not?), and serve it all in plain English. If you thought economics was dry, you're in for a treat—Powell just hinted that interest rate cuts might be on the horizon, despite an economy that can’t decide whether it’s still hot, not too shabby, or borderline shrug-worthy.

Powell’s Key Takeaways

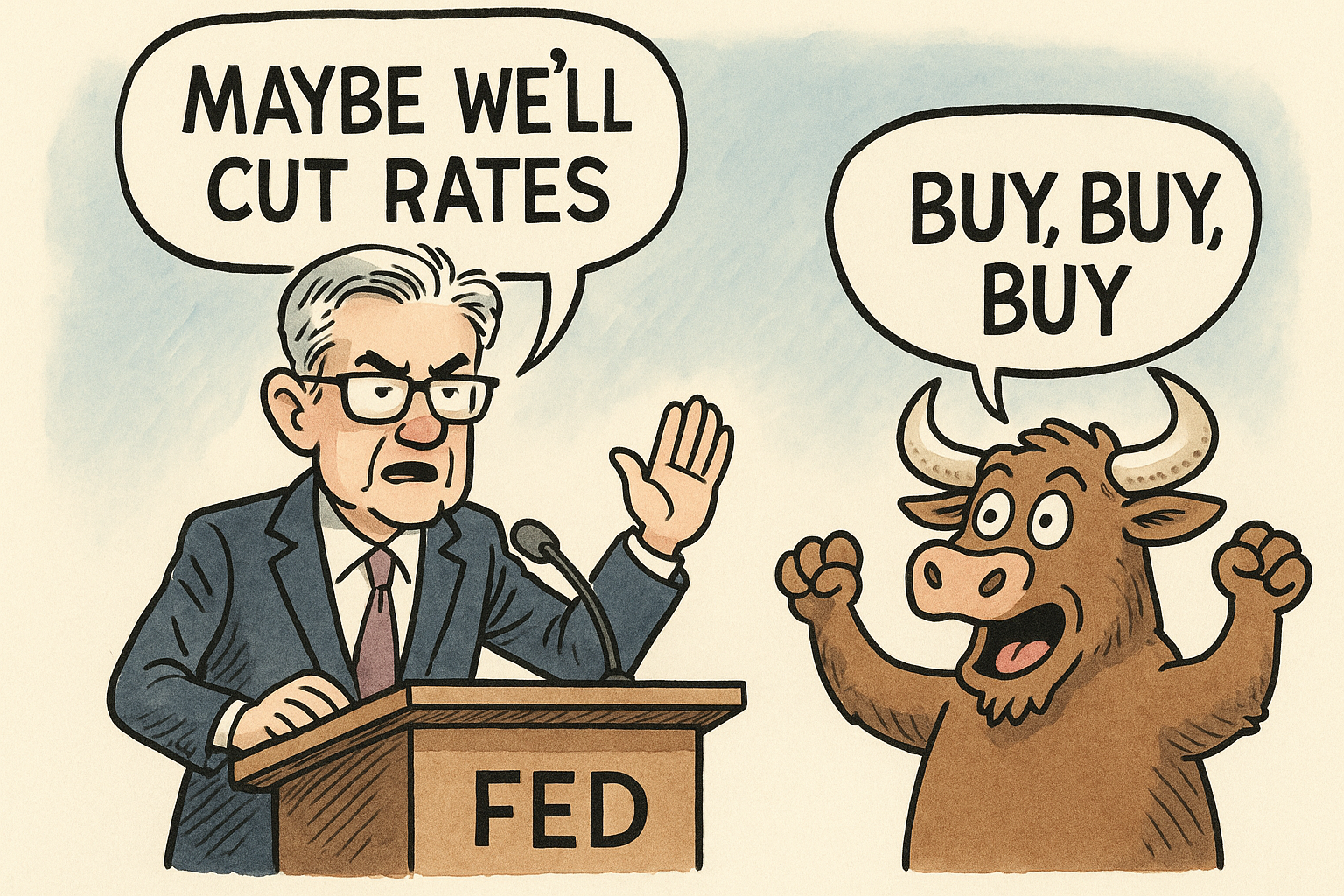

- "Maybe We’ll Cut Rates"

In a masterclass of subtle optimism, Powell said the current outlook and a shift in risk balance “may warrant” a change in monetary policy. Translation: don’t break the champagne corks yet, but maybe hold them loosely. - Labor Market—Sturdy Yet Mysterious

He flagged signs of a weakening labor market—because nothing says economic strategy like worrying about both strong and soft data. This, combined with inflationary pressures tied to tariffs, gives Powell a legitimate excuse to keep rate cuts on the table. - New Five-Year Monetary Framework

In a rare moment of clarity, the Fed has scrapped its previous vague tolerance for inflation above 2%. Now it wants clear, balanced pursuit of price stability and maximum employment. In other words: no more lazy language—just laser-focused policy.

Market Response

- Wall Street Ditched Its Restraint

Stocks went full fireworks mode. The Dow soared nearly 850 points to a record close, while the S&P 500 and Nasdaq followed in sunny “we love rate cuts” enthusiasm. - Bond Yields Tumble, Dollar Wobbles

Investors ramped up bets on a September rate cut. Treasury yields plunged, and the dollar weakened—making U.S. exports slightly less painful. - Rate Cut Bets Surge

As of today, markets see about a 90% chance of at least a 25 basis-point cut next month. Yes, that’s almost thumbs-up level of confidence.

What Does This Mean for Investors?

Here’s where it gets fun (or confusing, depending on how much coffee you’ve had):

The Positives of a Rate Cut

- Cheaper Borrowing – Mortgages, car loans, business credit — all a little less painful. Think of it as the Fed slipping you a coupon code at checkout.

- Stock Market Cheer – Lower rates make bonds less attractive, which often sends more money flowing into stocks. Investors love a dovish Fed almost as much as they love free donuts in the breakroom.

- Corporate Boost – Companies can refinance debt more cheaply, invest more, and maybe even boost earnings. Shareholders usually don’t complain about that.

- Lower Interest Charges – When the Fed lowers rates, the cost of servicing the $37+ trillion U.S. national debt drops. Treasury pays less to roll over short-term bills and issue new debt. Think of it as refinancing your credit card balance at a lower rate — except the balance is in the trillions.

The Negatives of a Rate Cut

- Savers Get the Short End – Bank CDs and money market yields? Kiss those peak payouts goodbye. Your “safe” cash stops working overtime.

- Inflation Risk – Lower rates can stoke demand, and if prices are already running hot, well…that’s like pouring lighter fluid on a campfire and then being surprised when your eyebrows vanish.

- Signal of Weakness – Sometimes a rate cut screams, “Hey, the economy’s slowing down more than we’d like.” Not exactly confidence-inspiring.

- Encourages Risky Behavior – When money is cheap, investors (and companies) start reaching for yield like it’s the last donut in the box. This can lead to bubbles in a plethora of assets - stocks, housing, crypto, etc.

And If Inflation Stays Sticky…

This is the kicker. If Powell cuts rates while inflation refuses to budge:

- The long end of the yield curve (10–30 year Treasury rates) could rise. Translation: long-term bonds might start demanding “hazard pay” for holding U.S. debt in a sticky inflation environment.

- That steepens the curve in the wrong way — short rates down, long rates up — which isn’t exactly the “mission accomplished” banner the Fed wants to hang.

- Investors in long-dated bonds could get whacked, while borrowers with 30-year loans might start feeling less smug about locking in “forever cheap money.”

- a Rate Cut Could Backfire – If the Fed cuts rates while inflation is still sticky, you’re pumping the gas pedal while the engine’s already overheating. Demand might hold up, prices stay high, but growth keeps crawling.

Conclusion

So, what did we just witness? At the annual Jackson Hole pow-wow, Powell managed to do something rare—offer hope without committing to anything, raise concerns with mixed data, then soothe them with verbal ambiguity. Markets, as always, chose the hope.

Takeaway for Members Wealth: This speech didn’t change the Fed’s mind—but it polished it, gave it a wink, and now the market is convinced it’ll lean dovish by September. Economic data may be mixed, but sentiment? Pure bullish optimism, salted with just enough caution to keep Die-Hard Bears awake.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author – Tim Macarak CFP®

Tim Macarak is President & Head of Wealth Management at Member’s Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure overtime, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Tim and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs and is determined to put service before all else.

Tim is a CERTIFIED FINANCIAL PLANNER® Professional. Outside work, he enjoys spending time with his wife and kids, Skiing, Coaching, and Traveling. To learn more about Tim, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- February 2026 (5)

- January 2026 (6)

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)