Share this

Jobs, Robots, Inflation, and Yield Curves

by Dane Czaplicki on Oct 27, 2025

How the Fed’s cuts are colliding with fiscal reality (and a few million robots)

(bear with me – wordy and covering bonds today – had a little extra time this Saturday morning here in OCNJ. Quiet this time of year. Brought down my daughter and her friends for her 16th birthday. At 16 they want little from me, so... what's a bear steepener again? What CIOs do for fun!!)

What bubble?

I’ve been told I sound a little “negative” lately. Fair. I am negative. And positive. Depends on the day, the time, the news, and probably what I had for breakfast. I’m human.

Thankfully, for all of us, we have an investment framework and a wealth management process that’s designed to keep my (and your) behavioral quirks from steering the ship.

Jobs and inflation: the twin pillars of market mood.

According to Friday’s read on October 24th, inflation came in (3%) a little cooler than expected…perfectly matching my Friday morning dog walk, which was also a little cooler than expected. Stock markets rallied out of the gate, encouraged by the idea that the Fed now has an “all clear” to keep cutting rates.

And yet, layoffs seem to be popping up daily. Just this week alone: Applied Materials, Meta, and Target (their first in a decade), to name a few. Even Meta’s AI division saw cuts. Wait, what? I thought AI jobs were supposed to be the one sector where jobs were in demand.

Amazon’s update was quieter but telling. They are expecting double the output over the coming years without increasing headcount. Translation: robots. Millions of them.

If I were a twenty-something right now, job hunting would be tough. But if I were a robot? Endless opportunities. No emotions, no burnout, and a literal off switch. Then again, humans seem determined not to let them power down, which feels like our anxious way of making robots more like us.

I thought we were supposed to be making them better than us. Maybe “robot rights” should start with mandatory off switches.

Meanwhile, on the topic of health span vs. lifespan, it seems robots will live at a perfect 1:1 ratio. No health, no life. No aging, no retirement, no being put out to pasture.

Alright, enough fun.

Let’s talk yield curves.

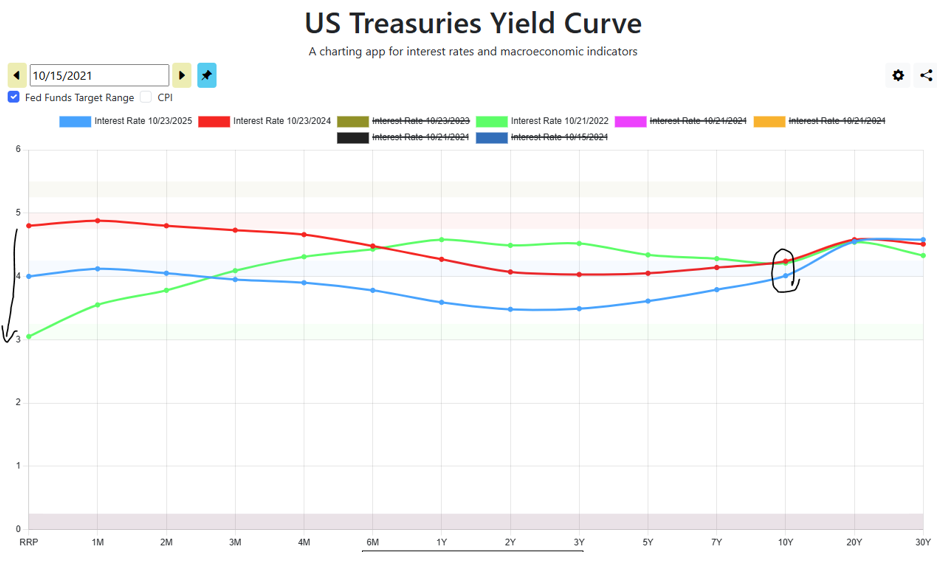

(Take a look at the charts below before we dive deeper…)

All this talk of interest rate cuts and though the Fed has dropped rates 200 bps or 2% or so, in this graph. Arrow on the left side. Take a look at the 10 (circle in graph) 20 and 30 year. Barely moved.

So what gives?

The Fed controls short-term rates, the left side of the yield curve, through the Federal Funds Rate. When it cuts rates (like the 200 basis-point drop shown here), that directly affects short-term borrowing costs: savings accounts, CDs, adjustable mortgages, etc.

But the long end, the 10-, 20-, and 30-year Treasury yields, is mostly market-driven. These reflect investor expectations about:

- Future inflation

- Economic growth

- Fiscal policy (government borrowing)

- Term premium — the extra yield investors demand for tying up money for decades.

So when the Fed cuts rates but long yields don’t move much, it usually means:

- Markets don’t believe inflation will fall fast enough to justify much lower long-term yields.

- Debt issuance is heavy, and global investors are demanding higher returns to buy long bonds.

- The economy isn’t collapsing, yet, so there’s no “flight to safety” bid pushing yields lower.

- Or the Fed may be behind the curve, and markets expect rates to rise again later.

A Simple Visual Analogy

Think of the yield curve like a seesaw:

- The Fed sits on one end — controlling the short side.

- Global investors sit on the other — controlling the long side.

When the Fed jumps off its end (cutting rates), the other side doesn’t automatically move. The market decides whether to lean with them — or not.

Is this all normal or abnormal?

It’s somewhat abnormal for the long end of the curve to stay elevated when the Fed is cutting aggressively, but it’s not unheard of. It usually signals that something is different about the underlying inflation, fiscal, or supply dynamics.

Let’s unpack it.

- Typical Rate-Cut Cycle Behavior

In a textbook easing cycle:

- The Fed cuts the front end of the curve

- Investors expect weaker growth and lower inflation ahead.

- Demand for long bonds rises → 10- and 30-year yields fall. (Remember, demand means buying bonds, which pushes prices up and yields down – inverse relationship)

- The curve may still steepen (short rates down faster than long rates) but in general rates down down across the curve.

This pattern happened in classic recessions:

- 2001, 2008, 2020 - the long end collapsed as the Fed eased and investors fled to safety.

- What’s Happening Now (and Why It’s a little Odd)

If the Fed has already cut ~200 bps but 10-, 20-, 30-year yields barely budge, the market’s sending a message. Some interpretations include:

- Inflation expectations remain sticky. Investors don’t trust that inflation will get to targeted 2%, nor perhaps will it stay at an “ok” 3%, but potentially rise.

- Fiscal supply is enormous. The U.S. Treasury is issuing record debt, and buyers want higher long-term yields to absorb it.

- Term premium has returned. For most of the 2010s, investors did not get paid for holding long-term bonds, now they are slowly but surely demanding it.

- Global yield parity has shifted. Other developed markets (Japan, Europe) are no longer at zero, so U.S. yields can’t just collapse without losing capital flows.

So rather than a traditional “flight to safety” steepening (like 2001 2008 and 2020), you get what I’d call a bearish-leaning steepener — or more simply, a sticky long end — where the Fed eases, but markets don’t reward it with lower long-term borrowing costs. I say leaning steepener because long rates aren't jumping up quite yet….but I could be wrong.

- Why It Matters – Does it Matter?

- Mortgage rates and corporate borrowing costs are tied to the long end, not the Fed Funds rate; so easing might not stimulate as much as hoped. (finally a bit of a pull back in home prices perhaps, as there are more sellers than buyers)

- It suggests a regime shift: deglobalization, larger deficits, and persistent inflation risk could mean a higher-for-longer long end, even in easing cycles. (playing out in gold perhaps?)

- For investors, it’s a cue to rethink duration exposure and real-yield opportunities. (challenging – if you are too short in terms of the bonds you own, your yield is fleeting from reinvestment risk as the short end drops, but if you are too long in bonds you own, then you run the risk of principal loss as long term rates rise. In other words: everyone’s trying to gobble up yield while it’s still around. Get in my belly! (Austin Powers? – oh boy)

Bottom Line

Normally, the yield curve steepens down in a rate-cut cycle (short end plunges, long end drifts lower).

If the long end doesn’t move, it’s not a policy error. It’s a reminder that markets don’t take marching orders from the Fed. They read the room. And right now, the room still smells a bit like inflation and deficits.

Well, duh.

If you’d like to see how our investment framework helps navigate rate cuts, fiscal headwinds, and everything in between..

Schedule a conversation with our team.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author

Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)