Share this

The Fed Holds... Again

by Tim Macarak on Jul 31, 2025

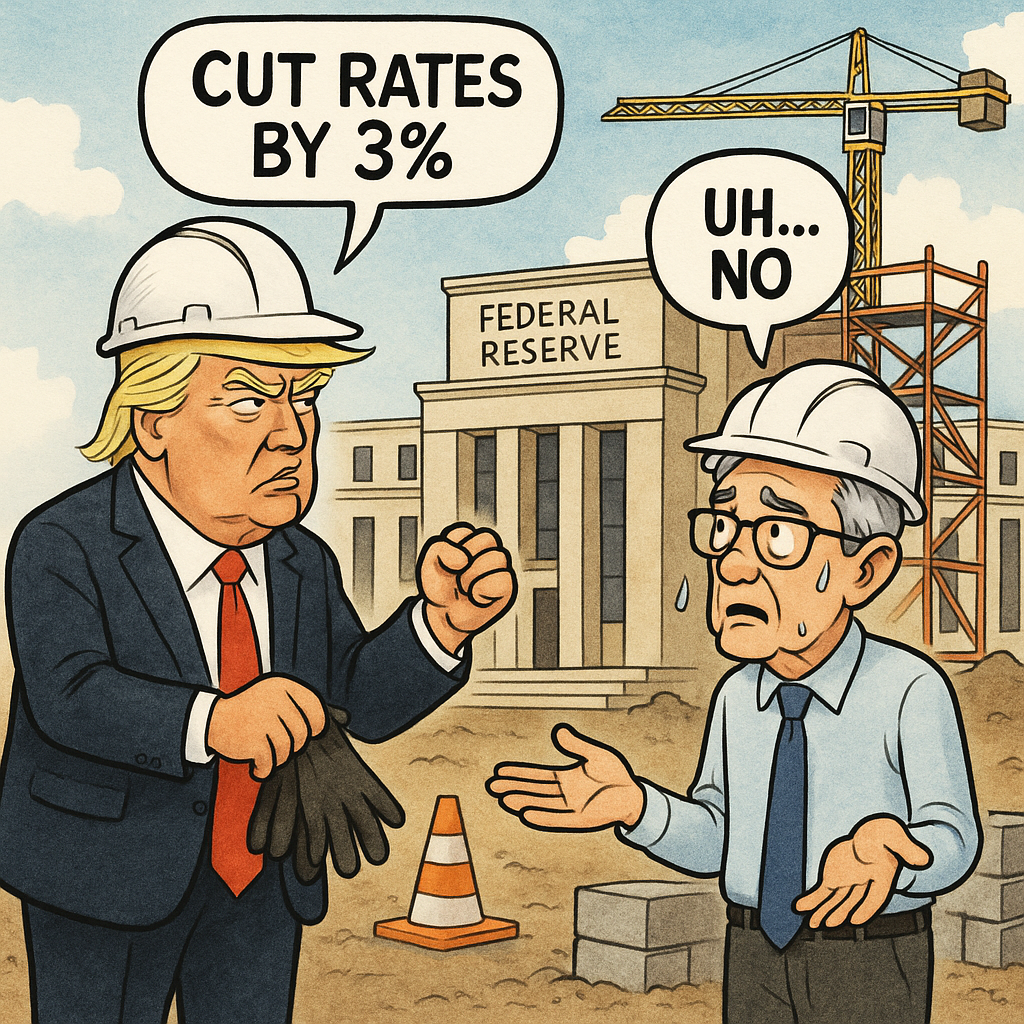

But the Gloves Are Off

The Fed didn’t cut rates yesterday—but it did drop a surprise: a rare public split at the top. For the first time since 1993, two sitting Fed governors, Michelle Bowman and Christopher Waller, broke ranks and dissented. Both Trump appointees ' shift toward dovishness (cutting rates) marks a notable change in tone. Meanwhile, President Trump has been anything but subtle—publicly demanding a 3% rate cut. Yet despite the political pressure, Powell and the majority held the line.

Powell’s Key Takeaways (and Undercurrents)

- Inflation? Still Too Hot to Handle: Powell reiterated that inflation remains above the 2% target, and while there’s been some progress, it’s not enough to justify a rate cut. He referred to the situation as “elevated uncertainty,” — which in Fed-speak means: we’re not quite sure what the heck is going on yet.

- Tariffs Add a Twist:

The recently imposed tariffs are starting to show up in prices, but Powell isn’t ready to say whether it’s a one-time bump or the start of a more persistent trend. Translation: the Fed doesn’t want to chase shadows — or make policy based on what might happen. - Mixed Economic Signals:

Powell emphasized that "the unemployment rate remains low and the labor market is at or near maximum employment"—showing continued resilience in jobs data. Powell also pointed out some soft spots: hiring has slowed, consumer spending isn’t as robust, and job growth outside the public sector is described as “near stall speed.” In other words, the economic engine is humming—but not exactly revving. - Two-Sided Risks: Powell summed up the situation by stating, “we have two-sided risk to both of our goals.” The Fed is balancing potential downside risk to the labor market if policy remains too tight, versus the risk of inflation staying above target if loosened too soon. It’s a classic Fed juggling act — trying to cool things off without knocking anything (or anyone) over.

Market Response: Optimism Turned into Oh-No

Markets held steady throughout Powell’s initial remarks—clearly hoping that rising dissent within the Fed might signal cuts on the horizon.

But when the Q&A began at 2:30 PM, and Powell reaffirmed that inflation is still too high and that current policy remains restrictive, stocks sold off sharply, giving up earlier gains.

The takeaway? A reminder that hope is not a strategy, especially when your Fed Chair is being called “Mr. Too Late” by the President—and then lives up to it, depending on your point of view.

Conclusion: A Fed Divided — and the Stakes Are Rising

This is no ordinary policy debate—it’s becoming a high-stakes standoff. On one side: Team Trump, including two sitting Fed governors, pushing hard for rate cuts and citing slowing job growth and weakening consumer demand. On the other hand, Team Powell, holding the line in defense of the Fed’s inflation-fighting credibility, is unwilling to cut prematurely and risk reigniting price pressures.

The public split is significant. Dissent at the Fed is rare—dissent from two sitting governors is nearly unheard of. It sends a message not only to markets but to Washington: the pressure is mounting, the data is noisy, and the road ahead is anything but certain.

With inflation still above target, economic signals mixed, and political interference ramping up, the Fed faces a difficult few months. September’s meeting could mark a major turning point—or simply reinforce the gridlock.

One thing is clear: the gloves are off, and the next move could reshape the economic narrative heading into election season.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results. The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author – Tim Macarak CFP®

Tim Macarak is President & Head of Wealth Management at Member’s Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure overtime, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Tim and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs and is determined to put service before all else.

Tim is a CERTIFIED FINANCIAL PLANNER® Professional. Outside work, he enjoys spending time with his wife and kids, Skiing, Coaching, and Traveling. To learn more about Tim, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- February 2026 (1)

- January 2026 (6)

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)