Share this

Mind the Ride: Markets at Record Highs, Risks in the Shadows

by Dane Czaplicki on Sep 22, 2025

This Week in Markets

This week, I met with clients, former colleagues, prospects, centers of influence, and our team. A common theme emerged: bewilderment.

On one hand, wealth is being created at a pace that feels almost surreal. On the other, no one wants to step off the ride while it’s going up.

“Trump’s back—doesn’t that mean markets will just follow the 2016–2020 playbook?”

“I know diversification matters, but this AI cycle is unlike anything in history. Shouldn’t I just add more?”

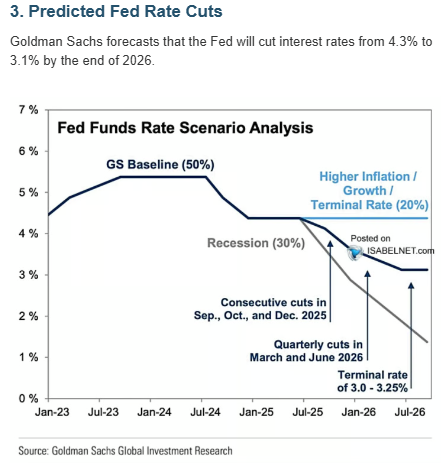

“The Fed’s cutting rates. Doesn’t that mean the stock market has nowhere to go but higher?”

It all feels good— record highs, easing borrowing costs, US tech dominance. But it’s happening against the backdrop of stagflation whispers, tariff noise, geopolitical instability, and U.S. equity valuations flirting with all-time extremes.

This is the paradox: Bull markets rarely end just because of valuations and more money is lost waiting for the bear market than in the bear market itself, HOWEVER, bull markets do end, and much money is lost in bear markets.

That’s why I love stepping back from the day-to-day noise. A single chart, in isolation, can look bullish or bearish depending on your mood. But over a week? The truth is usually both.

One particular aggregator of charts[i] sends a daily email with typically about ten charts from various sources. This week I grabbed a handful of my favorite charts from this week's five emails and pasted them below.

Rather than sort the following charts into “positive” and “negative,” I’ll let you decide.

The Question referencing each chart is above the corresponding chart.

How do Small Cap Stocks breaking out to all time highs make you feel?

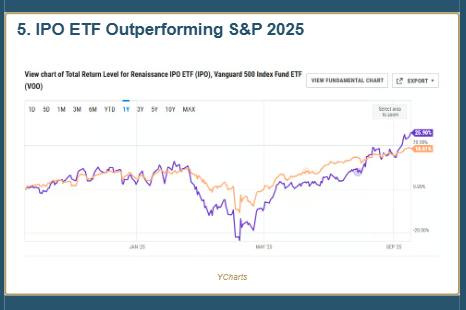

What about a basket of Initial Public Offerings outperforming other stocks?

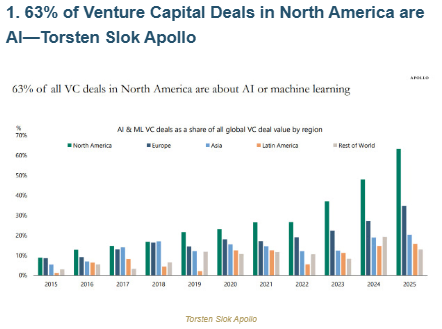

What about 2/3rds of venture investment capital going specifically to AI deals?

It looks like interest rates are going lower – Is that good or bad?

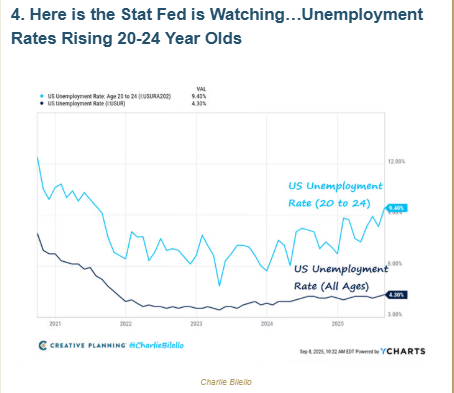

The Fed seems more concerned with jobs than inflation…Are you?

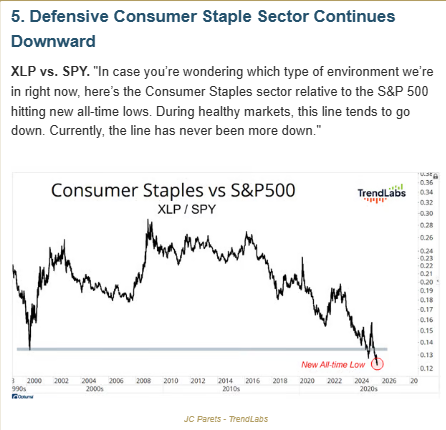

With your “safe” stock investments basically getting trounced by everything else…does that have you sleep well or stir restlessly?

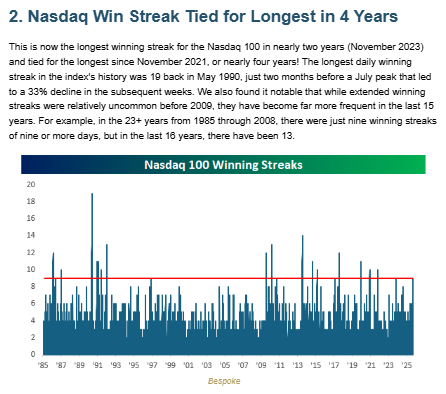

Who doesn’t love a win streaking heading into playoff season but what about the Nasdaq cranking relentlessly higher?

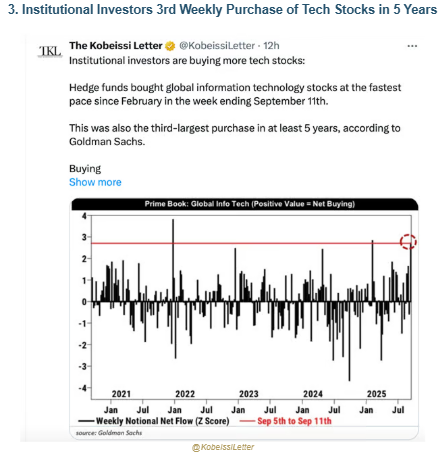

In case you were wondering where the big money was flowing, its tech again…well at least that helps explain the record streak in the Nasdaq…

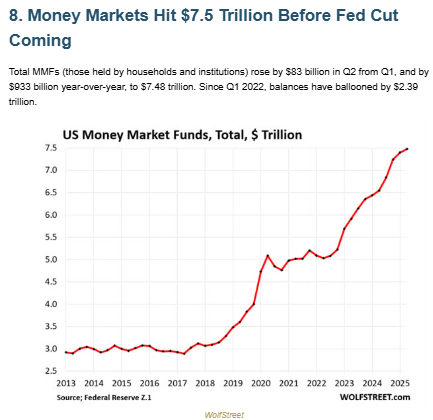

We know of the Fed Put, The Trump Put but what about the HUGE Money Market Put….There is so much cash to put to work…how could anything ever down in price???

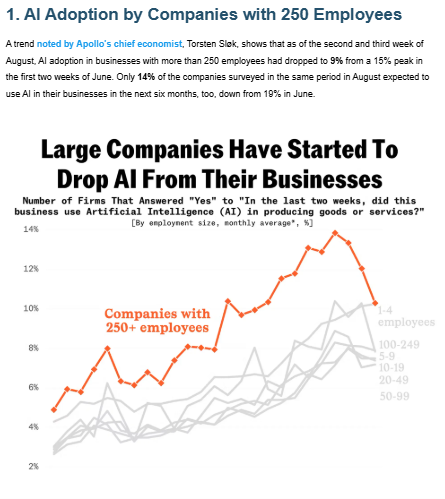

Wait I thought everyone was adopting AI at a faster and faster clip…what does this chart say to you….

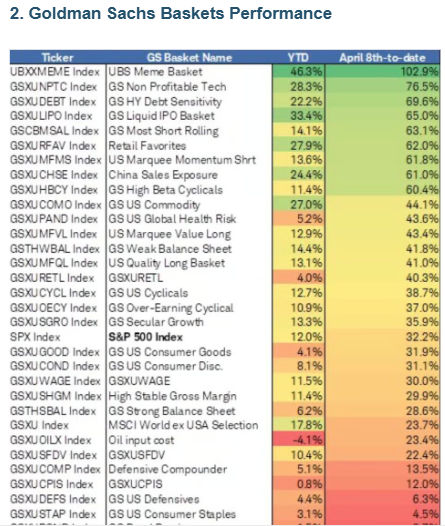

Meme Stocks, Non Profitable Companies, Hi Yield, IPOs at the top of the top performing stocks….RISK ON Everyone…make you feel good or bad?

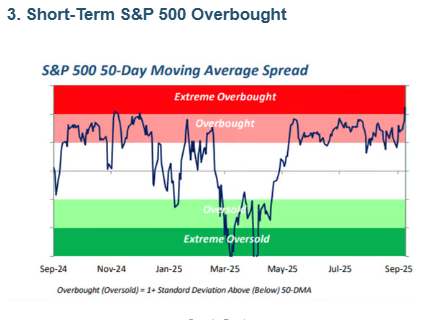

And this OverBought indicator was early in the week before the strong record finish…is that good or bad?

So, we have to stay mindful—of both the risks and the opportunities. My partner, Tim Macarak, CFP®, put it well this week: “With U.S. equity valuations looking stretched, our guidance remains to maintain your target allocations rather than chase performance.”

And as I suggested to a former colleague over lunch at Ariano, while enjoying their Otino Chipino, sometimes it’s perfectly fine to ring the register. Taking some gains isn’t weakness—it’s discipline.

Remember, in investing, even doing nothing is still doing something.

[i] https://view.lansingadv.com/

If you’re wondering how to balance risk and opportunity in today’s market, let’s talk. Our team can help you review your portfolio, refine your strategy, and position with confidence.

Schedule a conversations with us today.

Investment strategies, including rebalancing, do not guarantee improved performance and involve risk, including potential loss of principal. Past performance does not guarantee future results.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

About the Author

Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Investment advisory services are offered through Members’ Wealth, LLC., a Registered Investment Advisory Firm.

Registration with the SEC does not imply a certain level of skill or training. We are an independent advisory firm helping individuals achieve their financial needs and goals

Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

This commentary reflects the personal opinions, viewpoints and analyses of the Members’ Wealth, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Members’ Wealth, LLC or performance returns of any Members’ Wealth, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Members’ Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

Copyright © 2023 Members' Wealth LLC

Share this

- February 2026 (1)

- January 2026 (6)

- December 2025 (6)

- November 2025 (8)

- October 2025 (10)

- September 2025 (10)

- August 2025 (10)

- July 2025 (14)

- June 2025 (10)

- May 2025 (12)

- April 2025 (11)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)